Donations Evaluation Guide

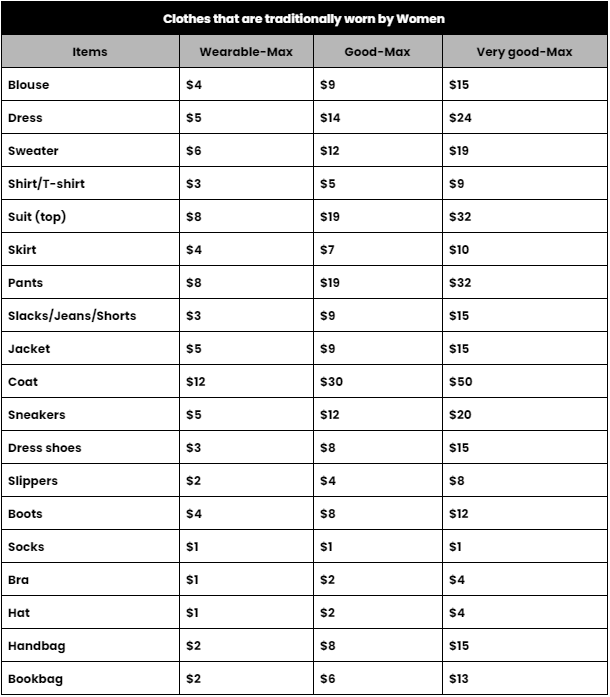

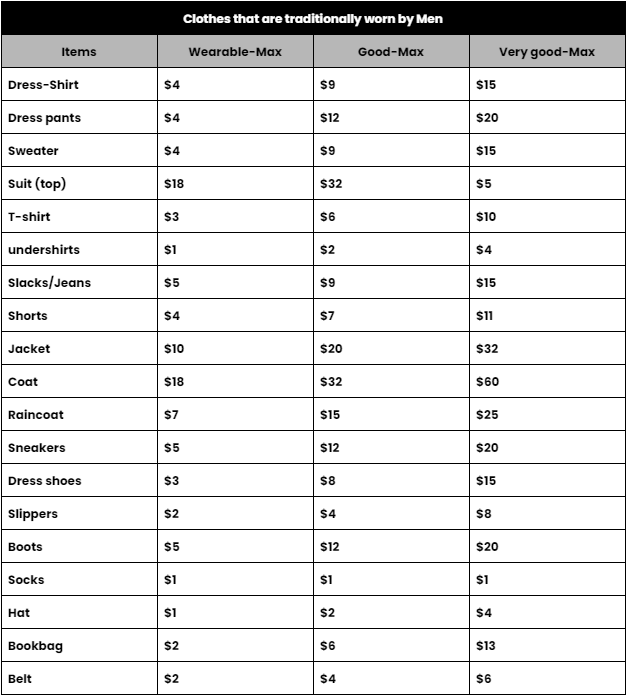

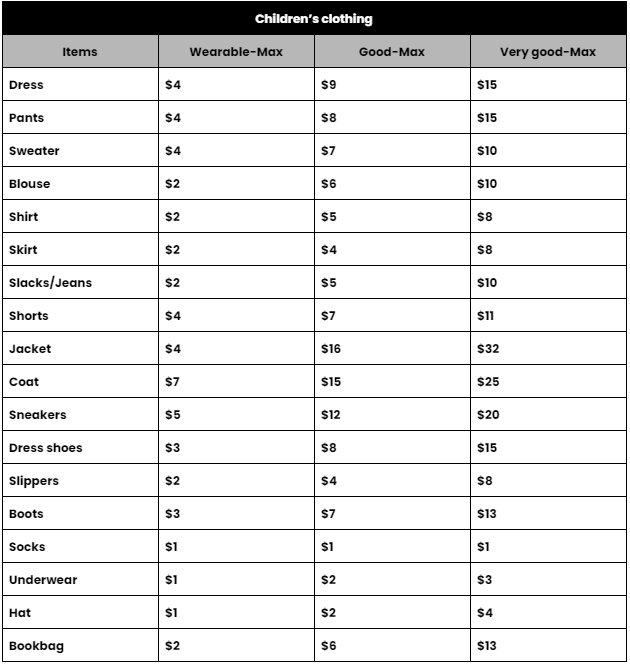

The CRA requires that we evaluate Non-Cash-Gifts’ fair market value. We have listed the approximate value range that you can use to estimate each item accepted based on values we have seen at Salvation Army and Goodwill. Items that are deemed not wearable by our standards will unfortunately not be returned nor issued a tax receipt.

Please use the attached blank sheet for your donation declaration to list each item, its size and its estimated purchase cost. This will helps us assign a value based on original cost and current quality. We also ask you to consider entering a cash value amount that you would like to donate to support the shipping/handling and administrative cost to deliver your gifts.

Please note: Items that are not on this list may or may not receive a tax receipt. We ask that you inquire with us before donating such items.

Following the evaluation of your donation, a tax receipt will be emailed or mailed to you based on your preference.

Please click on each tab to see the respective donation guides